Table of Contents

CVV2/CVC2/CID is a security feature for transactions where your credit card is not physically present. It is a three or four digit value which provides our payment system with a check of your credit card’s authenticity. The terms are generally used interchangeably. CVV2 stands for “Card Verification Value 2”, CVC2 stands for “Card Validation Code 2” and CID (Card Identification Number, for American Express) are values that are used as a security feature for verifying your credit card while making “card not present” transactions.

Verification numbers help us to verify two things:Your credit card is in your possession. Your credit card account is legitimate. Verification numbers are only on the card – they are not contained in the magnetic stripe information, nor do they appear on sales receipts or statements.

Using the credit card verification number helps us minimize the risk of unknowingly accepting a counterfeit card or being a victim of fraud.

Visa and MasterCard

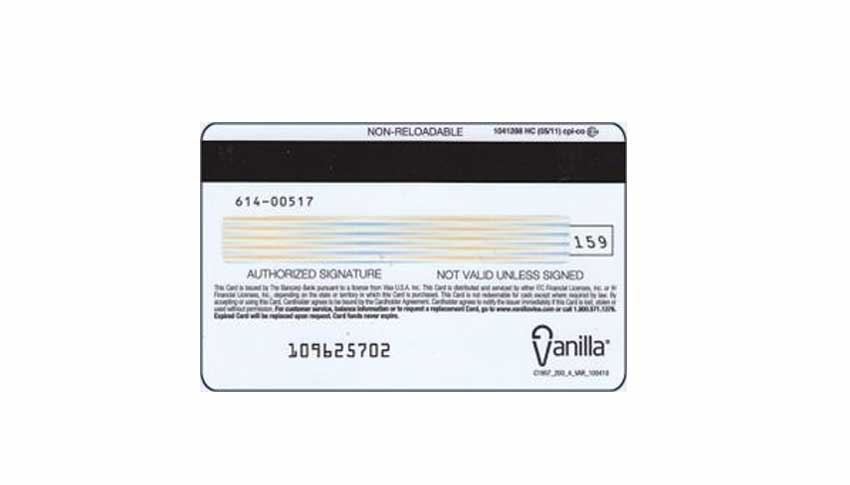

For Visa and MasterCard, it is a three-digit value that is usually printed in reverse italics and featured on the right side of the signature line on the back of the card.

CVV2 code on the back of a Visa credit card

American Express

For American Express cards, the number is located on the front of your card, on the right hand side above your card number. The number on American Express cards is four digits long.

CID code on the front of an Amex card

How to find the CVV code according to the type of credit card

| Net | Location on the card | number of digits |

| Visa | Back of the card, to the right of the signature | 3 |

| MasterCard | Back of the card, to the right of the signature | 3 |

| Discover | Back of the card, to the right of the signature | 3 |

| American Express | Front of card, above and to the right of the number | 4 |

When is it necessary to use the CVV code of a credit card?

If you’ve paid by credit card before, you probably know that you don’t need to provide the card’s security code when making a purchase in person. This is because, basically, the information on the card is “read” and “authenticated” when you swipe it through the EMV chip reader, or when you hold it up to a wireless payment terminal.

However, the security code is almost always required for “cardless” transactions, that is, those that take place online or over the phone. Being able to provide this information tells the seller that you are the owner of the card, which in theory ensures that the transaction is not fraudulent.

It’s important to note that while merchants are responsible for requesting the CVV code before approving payment, not all merchants will choose to do so. Due to the fact that certain people may find their security codes unreadable or have difficulty finding it, some stores skip the security code verification step in case it hinders the checkout process. In other words, they don’t want an extra step that might prevent a purchase from completing.

Why is the CVC code important?

The added protection provided by credit card security codes is one reason why fraud only affects less than 1% of all electronic transactions. While credit card fraud can still occur even with transactions that require a security code, this extra layer of protection definitely helps prevent it from happening.

When a merchant asks for the CVV code, all they want is to make sure the person has a genuine card. Also, the code cannot be found anywhere else, as merchants are prohibited from storing it, along with PIN codes and magstripe data. Because this data is never stored, it is more difficult, but not impossible, for thieves to commit fraud, even if they have other card data in their possession.

Is the CVV code the same as the PIN?

The answer is: No, the CVV code is different from the PIN number, which is used to make ATM withdrawals. On the other hand, the CVC or CVV code is used to verify payments online or by phone when you cannot use the PIN or signature.

Although the CVV number exists to protect your credit card from fraudulent transactions or phishing scams, it is important to know that there is still a chance that your credit card could be the victim of a scam. For that reason, it’s important to use a credit card only on secure sites and to track account status to track and detect suspicious transactions. If you find one, be sure to contact the bank right away to report the problem and protect your finances.

Should I share my card security code?

In situations where you’re buying something online on a secure page, it’s okay to share the security code with the seller. Just be careful where (or with whom) you share it, as there are numerous scams designed specifically to retrieve a credit card security code.

Typically, a scammer first gets hold of your credit card number, your full name, and expiration date, so all they need is the security code. Although they use various methods to obtain this information, many will choose to call pretending to be the bank. It is very important to know that banks will never ask you for confidential financial information over the phone, so never provide this information if you ever receive a call like this. We strongly recommend that you always keep your security code secret.

However, sometimes you may need to provide your card information over the phone. If you are calling a seller to make a purchase, then it is acceptable to provide the code. And just as in the case of online purchases, the seller cannot store this information. Now, if it’s the “seller” who contacts you first, it’s possible that the call is fraudulent.

Plus, you don’t have to worry too much about credit card fraud as long as you catch it early. In fact, major card issuers have $0 fraud liability guarantees, which means they won’t require you to pay for fraudulent transactions. Just be sure to monitor your credit card statements and credit reports so you can spot any fraud right away.

Other names given to credit card security codes

One of the most confusing things about a credit card security code is the variety of names used to describe it. Depending on the credit card network and the type of card you use, the code may be called:

- Card security code (CSC)

- Card verification number (CVN)

- Verification code (V-Code)

- Card verification data (CVD)

- Card verification or validation code (CVC or CVC2)

- Signature panel code (SPC)

- Card verification value (CVV or CVV2)

- Card verification value code (CVVC)

If you ever come across one of these complex-sounding terms, don’t be alarmed. Basically, all these terms refer to the same thing: The security code of a credit card.

Now, in the case of ‘contactless’ cards, there is usually a chip involved that supplies its own set of electronically generated codes. They are called Dynamic CVV or iCVV.

The progress of electronic commerce and the need for security codes CVV2 / CVC2

Electronic commerce has been extended in such a way that, according to the World Trade Organization, this medium is currently considered indispensable for the development of any company in the world.

These commercial activities have extended to all areas: between companies and governments (B2G), business to consumer (B2C), mobile electronic commerce and business to business (B2B)

Precisely the commercial transactions that have increased the most have been B2B, to the point that they currently represent 90% of electronic commerce and this has meant the daily movement of billions of dollars.

The remarkable number of financial transactions through the network and the astronomical sum behind them mean a huge temptation from there that banking companies have been in need of improving the security with which these transactions are carried out.

Precisely, one of the measures with which they have faced theft in the network through fraud with debit cards or credit cards has been with the incorporation of authentication mechanisms to these electronic banking instruments.

It is a security code that is printed on the back of the card and is normally required of the user each time they make a financial transaction online.

These three-digit security codes are known as CVC2 and CVV2 and the key to their use is that they require the user to have the card in their hand to view these numbers.

In these debit and credit cards, the location is on the back of it, while the composition of this security code corresponds to three digits. This is the case of MasterCard, Visa, Diners Club credit cards, among others.

In most of the cards the CVV2 / CVC2 are three digits, but in the case of the American Express credit cards it is four digits, nor is it found on the back in the signature panel code as in the majority but in the obverse, above the number.

However, recently in the MasterCard and Visa credit cards trying to avoid overwriting the numbers at the time of signing the card these three digits were located to the right of the signature space, in the signature panel code.

These changes in the location and composition of CVV2 / CVC2 prevents dishonest merchants or store employees from easily capturing the magnetic stripe data in these instruments and subsequently using them fraudulently.

In other words, we wanted to prevent malicious people with this data from making purchases online or phone purchases without having the card.

How much security do these security codes provide?

In the event that the card numbers are stolen, the option to request CVC2 and CVV2 prevents fraud.

This is due to the fact that the CVV2 / CVC2 are not stored in the database along with the other card data, this prevents them from being stolen as well.

The non-storage of these security codes in the terminals and payment gateways prevents employees, customer service and intruders from knowing this information.

In other words, personnel (whether authorized or malicious people) who enter the database cannot complete the card information necessary to carry out transactions.

This is a security procedure that has so far produced excellent results since it is legally supported by the Payment Card Industry Data Security Standard (PCI DSS), which also prohibits the authorization of subsequent transactions without the Use of this information.

Thanks to this implementation of security codes, e-commerce continues to expand and is projected as the predominant form of commercialization worldwide.

Alternatives to credit card security code

With technology moving at an exponential rate, we have now entered the era of digital wallets, which do not use the type of security codes that we have been discussing in this article. Instead, these virtual wallets, for example Apple Pay, generate a unique identification code each time a purchase is made online or at a point of sale.

This dynamic security code, also known as CVV3 or token cryptogram, replaces but has the same purpose as a credit card security code, ensuring that the payer is actually the owner of the account. The use of these proxy security codes is known as tokenization. These types of codes are used in EMV chip and contactless card transactions. Transactions using tokenization are more resistant to fraud than magnetic stripe transactions. That said, contactless cards still have traditional security codes that can be used.