Table of Contents

Certified Check Definition

The certified check is also known as an official certified check, together with the cashier’s check or in some countries called a cashier’s check or management check, they are guarantee mechanisms that the issuer or drawer has sufficient funds in mind to honor a payment.

The certified checks are a type of monetary instrument signed from an account in your name in the custody of a bank (rid) or other financial institution, which can be used to pay a third party since the certified bank in the instrument itself that sufficient funds are available for the check to be cashed without inconvenience.

While certified checks were once considered the safest way to accept a payment or service from someone you don’t know enough, check fraud has become commonplace. So it has been largely displaced by electronic transfers or direct deposits.

Despite the risk of counterfeit fraud, certified checks and cashier’s checks are still means of payment used in our time. We offer in this article the definition of certified check and its main characteristics.

What is a certified check?

The certified check is nothing more than a payment instrument through which the subscriber or holder of the checking account ordered the bank to certify or certify the adequacy of funds in the account, money that will be reserved for collection in favour of a third party (beneficiary or holder) when required.

For bankrate.com a certified check is obtained when an official of the bank custodian of the account certifies that the drawer or holder of the checking account has the funds available for the amount of the check at the time of issuance or certification. It is also certified that the signature on the check is genuine and the funds are reserved or blocked until the check is cashed.

If the certified check is not the product of a forgery, the beneficiary will have no problem collecting the check or depositing it in one of their accounts.

The main difference between the certified check and the cashier’s check is that in the second mode the bank debits the funds from the issuer’s account at the time the check is issued and undertakes to make the payment in the name of the beneficiary when he decides to cash it.

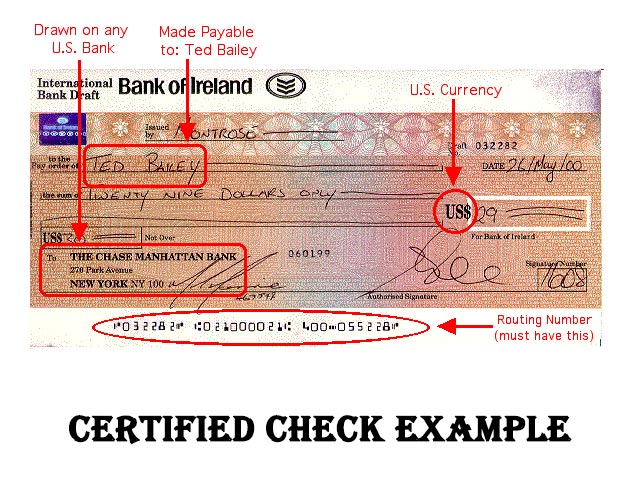

Certified Check Example

Characteristics of a Certified Check

When the beneficiary or holder of the check does not grant sufficient credits to the issuer, it may require certification of the check by the financial institution.

Thus, both the certified check and the cashier’s check and the money order ensure the existence of funds for the collection of the document. The characteristics of the certified check are:

- The issuer or drawer is the only one who can request the certification of the check.

- It must be in the name of an individual (natural person) or company (legal person)

- It is not negotiable, therefore the payment cannot be transferred. It can only be collected or deposited in the account in the name of the beneficiary.

- The vast majority are nominative, that is, non-transferable, therefore not endorsable.

- Two authorized signatures of bank officials are accompanied by the stamp and the “certified check, non-negotiable” caption.

- In case of cancellation, the drawer can request it if the check has not been cashed and is returned to the bank.

- In the vast majority of cases and unlike the cashier’s check, a checking account with the bank drawn is necessary.

- The certification is subject to commissions by the bank.

To receive a certified check, you must visit a financial institution or a bank and request certification of the check, this may include the purchase of the check or its certification. The certified check will have:

- The name of the issuing bank at the top

- The name of the account holder

- An account number of the drawer

- The date of issue

- The amount of the check written in number and number

- The palette “Pay to order” followed by the name of the beneficiary

- The “non-negotiable certified check” stamp and

- The signature of two authorized bank officials.

Some banks only issue certified checks to people with checking accounts. Both certified checks and cashier’s checks are issued against guaranteed funds, such as cash, a check in your favor from the bank where you are requesting the instrument or a deposit in that bank’s account.

The financial institutions charge fees for certified checks. These charges range from US $ 5 to US $ 30.

The certified checks false are sometimes used by criminals operating in fraud. You should always be cautious in suspicious situations when you receive a certified check by mail, malicious web pages, in the lotteries, for a job you do not remember having made or a business transaction in which you did not participate.

How to get a certified check

Certified checks are checks that have been guaranteed by your bank. They are frequently used for car and home advances. They are also used in situations where the creditor needs proof that the check will not be declined. To obtain a certified check, you must write a check and have it certified by a cashier. The bank then puts this amount on hold, ensuring that the funds will be in your account when the check is presented. You can only get certified checks at the bank where you have your checking account.

- Step 1

Review your financial records and make sure you have sufficient funds in your account to cover the certified check. Your bank may charge a fee for a certified check, so you must have enough to cover that cost as well. - Step 2

Talk to a bank teller. Explain that you need a certified check of a certain amount and have your account information ready. You may also need to present an identification form, such as a driver’s license. The cashier will verify your account balance and tell you to write the check. - Step 3

Make the check for the person you need to pay (as you normally would) and sign it. The cashier will seal your personal check with a certified stamp and return it to you. - Step 4

Record the name and amount of the check-in your check register, just like you would any other. The certified check can now be presented to the person who requested it.